The 15 colonies falling in the Municipal Corporation Gurugram – MCG area will be regular. However, the Government of Haryana approved a mechanism policy to regulate plots and buildings in these colonies. This will open the way for the development of infrastructure in these colonies and improve the living conditions of the people.

A spokesperson of the Haryana ULB Department said that the government announced 15 colonies for revalue include Cancun Enclave Part-1 and Part-2, Bhim Colony, Hari Nagar Extension Part-1 and Part-2, Shriram Colony, Devi Lal Extension, New Jyoti Park, Patel Nagar Extension, Shiva Nagar, Vikas Nagar, Area around Tikri Village, Ghosola Village, Naharpur Rupa Village, Yals around Jharsa Village Extension The Surat Nagar includes Phase 1 extension and the area around the village Harsaru.

There is a lack of civil facilities and infrastructure in these colonies. The plots and building owners will have to meet the standards given under the Policy Mechanism within 6 months.

Payment to Municipal Corporation Gurugram – MCG www.MCG.gov.in:

In these colonies, the plot owners who have already built houses will deposit their building plans with a check fee of 10 rupees per 10 square meter cover area and development charges @ 1250 rupees per square meter. 750 rupees per square meter development charge has been set for the surrounding area of Harsaru village.

In the case of vacant plots, plot owners will have to apply for a building plan with the necessary documents and check charges in Haryana Building Code -2017, with a development charge of Rs. 1250 / – per square meter.

If a person wants to deposit the development fee in installments, provisional clearance of the building plan will be approved but final approval will be available only after the development fee is completed. Development fees can be deposited in 6 equal installments with an interest of 6% in 3 years.

However, if a person does not apply for a building plan within 6 months, then such construction will be sealed and dropped against them under the Haryana Municipal Corporation Act-1994, assuming such constructions are unauthorized.

Discount on One-Time Development Fee Payment:

The owners of the plot and the building can also pay a 10% discount by pledging one lump sum before April 30. The Sijra scheme and layout of these colonies can be seen during any working day in the planning wing on the third floor of the office located in Sector-34, Municipal Corporation Gurugram.

One Rupee per Square Yard House Tax by Haryana Govt:

There is relief news for people who are facing problems due to the House Tax in Haryana state. Under the new policy of the Haryana Government and Gurugram Municipal Corporation, the citizens will have to pay the nominal.

Most importantly, the residents of Haryana including the commercial building owners will get the benefits under it. The Haryana Government has decided to levy a property tax at a nominal rate of One rupee per square yard on residential properties up to 250 square yards.

However, owners of this property have to pay a tax of up to Rs 250 only based on the size of the property.

Exempt Empty Plots up to 100 Square Yards:

In case of more than 100 square yards and empty plots up to 250 square yards, 50 paise per square yard will be taxed. In Faridabad, the number of units coming in the house tax rate is approximately 2 lakh 35 thousand. About 1.5 lakh of these are residential.

Residents are paying Gurugram Municipal Corporation (MCG) given the rising property dues; the civil body decides that it will snap water and sewage connections to MCG Gurugram property tax defaulter. Not only that, the expenditure incurred in doing this must be borne by these residents.

Reeling under Losses of Gurugram Municipal Corporation:

Municipal Corporation Gurugram – MCG officials say that the total amount of the corporation has risen by 400 crore rupees. When adjusted effectors rabbet, this amount comes to 250 million rupees. Most of the disadvantages are due to the MCG who were able to pay the taxes.

For example, more than 40 banquets have 9 crores, while MCG had given notice to clubhouses within the condominium for the first time. Now, the Regional Tax Officers are preparing a list of all residential and commercial buildings that pay for the MCG Gurugram Property Tax.

The notice will be slapped, in case of delay; the Authority will separate the water and sewage connection. Most importantly, Municipal Corporation Gurugram Commissioner Yashpal Yadav said, “We have further decided that all the expenses incurred in sealing the proceedings will be billed to the owners by making the respective property.”

Municipal Corporation Gurugram (Gurugram) Services

On this page, we will let you know the procedure for “Online Property or House Tax Payment, Change of Ownership in Property Tax Records and Search Property Tax Bill” under the Municipal Corporation of Gurugram. Check all the processes step by step and follow the instructions to avoid mistakes.

A-Section

-

Search MCG Gurugram Property Tax Bill & House Tax Payment Online in MCG MCG.gov.in:

I] => Firstly, for the house tax payment or to search the MCG Gurugram property tax bill you just have to visit the official website of MCG at www.MCG.gov.in webpage. Here on the home page, you can see the option “Property Tax”.

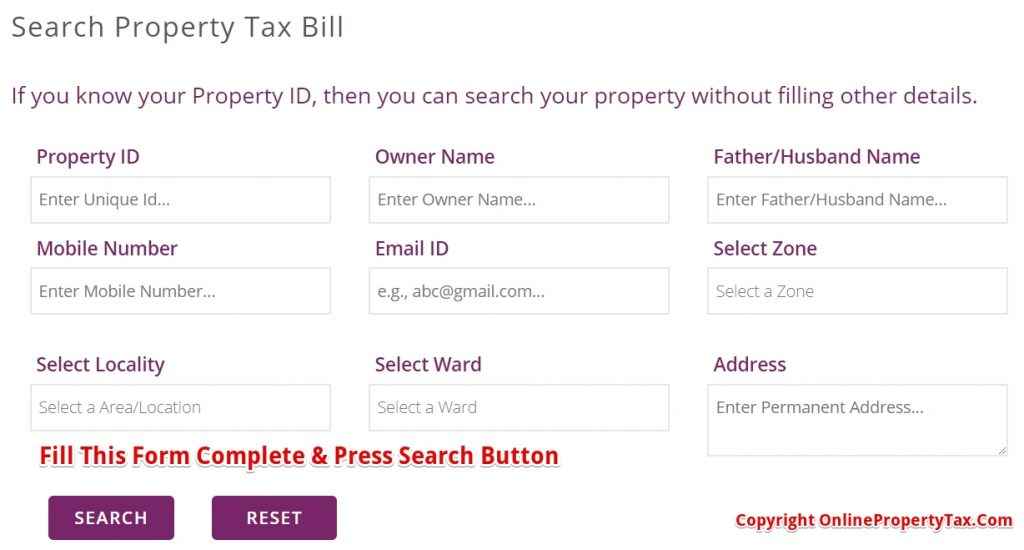

This option will provide you with the below available link page. On this website page, you will have to enter the following information and after that press the “Search” button:

- Property ID – Enter Property Unique ID.

- Owner Name – Write Property Owner’s Name.

- Father/Husband Name – Fill Property Owner’s Father/Husband Name.

- Mobile Number – Give 10 digits valid and registered Mobile Number.

- Email ID – Current valid and registered email address.

- Select Zone – Select Locality from the drop-down menu.

- Select Ward – Ward number from the given link.

- Address – Mention here the complete postal address of the property/house.

Search MCG Gurugram Property Tax Bill OR House Tax Payment

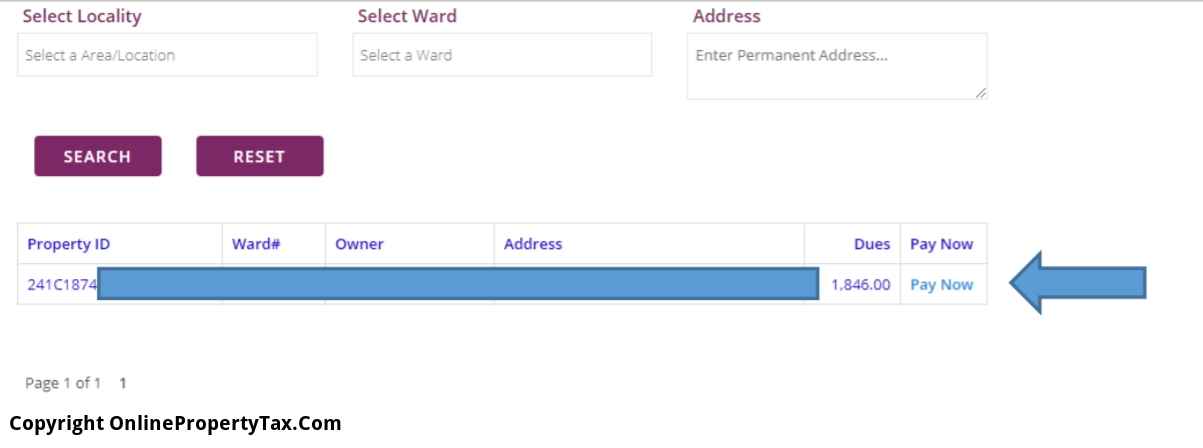

II] => Secondly, after that you will see the house/property details on the next page. Here you have to press the “Pay Now” button for making the online MCG Gurugram property tax or house tax payment in favor of Municipal Corporation Gurugram.

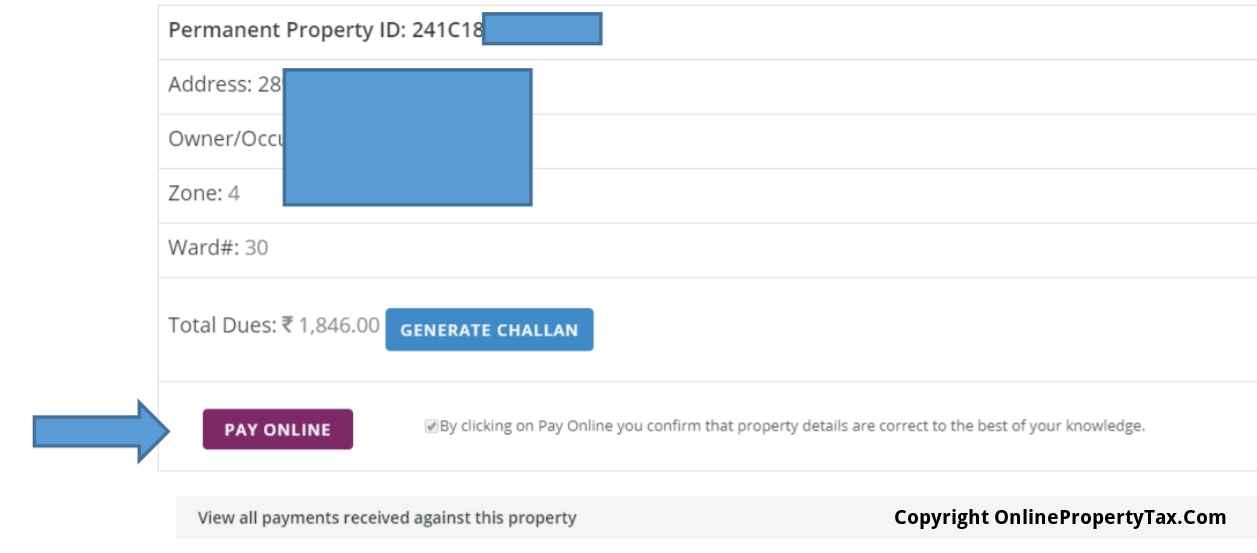

III] => Now you will have to check all the information on the next page. On this page, you will see the “Permanent Property ID, Owner Name, Zone Number, Ward Number, and Total House/Property Tax Dues”. Here press the “PAY ONLINE” button for making payment to Gurugram Nagar Nigam.

IV] => Then you can see the payment gateways that are available to pay the house tax in MCG. You can select one option from “HDFC, IDFC/CC Avenue PG, Paytm, Axis Bank, Airtel Money Wallet, Airtel Payments Bank, Mobikwik, OR ICICI Bank” payment gateways.

After selecting the gateway make your payment online and download the receipt. See the demo page photo below.

B-Section

-

Apply for Change/Correction of Ownership in MCG Gurugram Property Tax OR House Tax Records in MCG – MCG.gov.in:

The option for changing or correcting property/house ownership on tax records is also available on the official website. To get this page the option is also available here.

You can visit the below available link where you can see the option “Change/Correction of Ownership in MCG Gurugram Property Tax Records”. Under this page, two options are available as per following:

- Apply for Change of Ownership/ Name Correction in Property Tax Records

- Check Application Status

B1] => Apply for Change of Ownership/ Name Correction in MCG Gurugram Property Tax Records: To apply for the ownership change on the MCG Gurugram property tax records or name correction on house tax records just simply visit the below link.

Importantly, on this page, you will get the “Application for Change/Correction of Ownership in MCG Property Tax Record”.

After getting the page fill it with complete details such as “Property ID, Owner Name, Father/Husband Name, Mobile Number, Email ID, Select Zone, Select Ward, and Address”.

Then press the “Search” button and on the next screen on your computer, the application form will appear.

Apply for Ownership Change

B2] => Moreover, to check Application Status: For checking the application status, the option is available on the same page of MCG.gov.in website ownership change section.

The status is available through the below link where you just have to enter “Application Number and Applicant Name”. Subsequently, by filling in this information you can see the complete status details of your request.

Municipal Corporation Gurugram – MCG Helpline & Contact Details

Meanwhile, the citizens who are facing the problem while making the payment of MCG Gurugram property tax can contact the MCG helpline. Here below the office address and toll-free helpline number is available. Similarly, to contact the zone-wise officers or other officials visit the below link.

Zone Wise Officials Contact = http://www.MCG.gov.in/Contact-Us.aspx

MCG Office Location – C-1, Info City, Sector 34, Gurugram

MCG Toll-Free Helpline – 18001801817

I can not find the link for making ON LINE application for CHANGE IN OWNERSHIP of residential property in Gurgaon.

In present case, property ID is 323C37U61P107 as stated in property tax receipt dated 23.3.2021 ( payment ID 102804, payment date 23/Mar/2021 , Application no. 012219352, Property Tax no. 050122128010656 )

Property address is : F03-301, Tower D, The Palm Drive, Golf Course Extension Road, sector 66, Gurgaon. The Owner Dalip Sharma has sold this property to Veena Mehndiratta vide Registered Sale Deed ( Registration no. 8527 dated 25.3,2021

Please inform link for making ON LINE application for Name change of Owner.

I am unable to locate the CHANGE OF OWNERSHIP Option on the MCG website. Section B is not available. What should i do?

I had purchased an independent floor but soon thereafter due to insert of covid,I couldn’t get the property id, being a senior citizen.

I now want to pay my property tax but don’t know the procedure.

Please help.

Rgds

Col Dhawan

We recently brought a property( a builder floor). Thr property right now shows is been shown in the name of original owner, but now we want it to be name of 4 different residents. What is the process for same.

Property number 266C908U9P42

While the address is correct except that floor number given is 21 . It should be 23 . The apartment number is 623 A . Request correct this error .

Thanks and regards

What to do, to generate/register new property id. My property is 10 year old shop.

I need to change my Mobile Number

I want to change my mobile number in MCG Records. How to do please help me.

hi,

Please tell how to update mobile number in House tax record.

The link you suggest above not showing in mcg.gov.in

Hello ,Please help where I can get application for change in ownership of property in MCG gurgain ,I have checked but not getting this option.pls help

The link for change of name in ownership is not available on MCG portal

I want to change the name owner. This option is not there.

The property tax bill includes the tax amount and arrear of adjacent property as well. Owner of adjacent property is different. There is no option to raise this issue and get a correct bill.

Hello , I can’t locate the “Apply for Change/Correction of Ownership in MCG Gurgaon Property Tax OR House Tax Records in MCG – mcg.gov.in” can u please help me locate the same or share the link ..thanks

House property tax bill owner name change what process online

I need help to correct my name in the MCG records.

How do I update information in MCG and ULB website for registration

What is the procedure for transfer of property? I have cleared all the dues.

For changing the owner name is sales deed copy needs uploading

no option is coming for change in property tax

Looking for online process for change of name in Property tax Records in Municipal Corporation of Gurgaon

Pushpa Gupta

Mo.9818269486

Email: [email protected]

How to apply for mutation (change of name of property after death of husband) in Gurugram Haryana

How do you “Apply for Change of ownership” in the event of death of the owner of the flat. It is a DLF Flat

OR How do you download the form to” Apply for Change of ownership” of the Flat. The link – Apply for Ownership Change does not take you anyway

Please provide check list of documents required for applying for change of Propeprty ID due to change of ownership.

Not able to apply online property transfer

How to change ownership of property

I have applied for ownership in mcg. The objection raised is pending for non payment of objection fees . kindly advise how to pay on line.

My application no is 0120981049

Dear All,

How to do mcg Mutation from old property to new property.

regards

Gautam mehra

9313451004

propti id ma name changr

kasa cira

I need to correct my mobile number in property ID

I, jointly with my wife, purchased a flat in Pioneer Park Society of Gurugram, in July 2021. While trying to now pay 2022-23 propert tax (online), I notice that ownership details given there are of the previous owner.

How to get these records corrected and pay the due tax in our names?

Grateful for some expeditious advice, or name some agency who could get it done at some reasonable charge!

I moved application for change of name on the death of my mother the original owner of property. Tax due challon has been given with my name as owner but no order of change of ownership / mutation certificate is given. what is the standard procedure.

Sir, I have bought a residential property in Sector 52 Gurugram. How to change ownership name in Property records to enable me continue property tax payment.

We want to apply for change in ownership of our flat in a cooperative housing society in Gurugram in the records of Municipal Corporation of Gurugram so that the property tax can be issued in the new name.

The name change has been approved by the Assistant Registrar of Cooperative Societies, Civil Lines, Gurugram and endorsed in the share certificate by my Cooperative Housing Society in Sector 56, Gurugram.

Please advise me suitably in this regard

How to filing Self assistance for holding tax

I have purchased an apartment on resale. I want to change the ownership in the records of MCG. Please let me know the process.

there is no option to change the phone number on the MCG website. This is important and should be available.

I am staying in M3M Woodshire Sector-107, Gurgaon. The super area of my flat is 2746 Sq feet while covered area is 1603 Sq feet. In the conveyance deed only super area is mentioned (as the area was not under Municipal Corporation of Gurgaon at that time) and the Municipal Corporation of Gurgaon has taken super area as covered area and raised the property tax demand accordingly. The visit to Taxation officer has failed to bring any results. Unable to understand as to how to get it corrected and make the payment. Seek your assistance in resolving it.

I cant find my property id online for property tax payment @mcg.gov.in

Dear Sir,

This is to inform you that in the Property Details & Assessment Notice for the Financial Year-2023-2024 dated 08 August 2023 received on 12/09/23 received through your representative. From the perusal of the contents of the notice the MOBILE no 9868929960 linked to my property details is incorrect . My mobile no is 8800211633. Kindly make the necessary corrections. The mistake was intimated to your representative. My property details are as under as per records:

Name ; Shankar Basu. New Property Id: 1CH66EU7, Old Property Id:6C62U95, Plot No:422, Ssector 21

Category: Residential, Colony Name : Sector 21 Old & New owner name : Shankar Basu s/o. N.N. Basu

Requested that the nesessary correction may be carried out under intimation to me on my mail id:

[email protected]

Regards

Shankar Basu

I have purchased a society flat in Gurgaon Sector 56,I am unable to change my name in properly tax records online.

please suggest me the procedure to update my name in property tax records.