Property tax, is a direct tax amount, which is paid by the owner of an immovable property by the value of that property. The estimate of this tax is based on the property value. It is not important whether the owner has any benefit from that property. In this way, according to the original definition property tax is normally done by municipalities on the owners of real estate located in their jurisdiction, which is based on the value of that property.

This tax mainly applies to land, land improvement, man-made movable commodities such as houses, houses, shops, buildings, etc. The nature of this tax can be different in different countries. Taxation of Property Tax in India has been done under the Property Tax Act, of 1957. The Income Tax Department administers property tax rules by making the Property Tax Act, 1956, and under it, under the Department of Revenue in the Ministry of Finance, Government of India.

In India, the real owner of the property deposits this tax while tenants in the United Kingdom are also liable to pay this tax. The citizens will have to pay the property tax on an annual basis in India. Generally, this tax is levied based on the fair rent.

Often people consider property taxes and fix to be one, but both of these are different. In the event of a non-rental property, the value of the property is calculated based on the local tax rate.

GVMC Property Tax in Greater Visakhapatnam

As the fiscal year is ending, the Greater Visakhapatnam Municipal Corporation (GVMC) came up with a new master plan. To clear and get the long stacking tax amount and dues the GVMC recently has launched new software and a special drive for citizens.

Greater Visakhapatnam Municipal Corporation will give approximately 6 thousand notices to the citizens along with a 7 hundred warrants. The civic body also released the 2 thousand notices for all the property owners regarding the sale of their property.

Moving ahead the civic body also placed signboards in various places and on the lands so that they could pay their dues on time. So to avoid the chance of your name coming on this list you must pay the tax on time.

Here we are providing you the complete procedure for making payment online of Andhra Pradesh AP GVMC Property Tax.

GVMC Property Tax Online Payment in Greater Visakhapatnam Municipal Corporation, Andhra Pradesh:

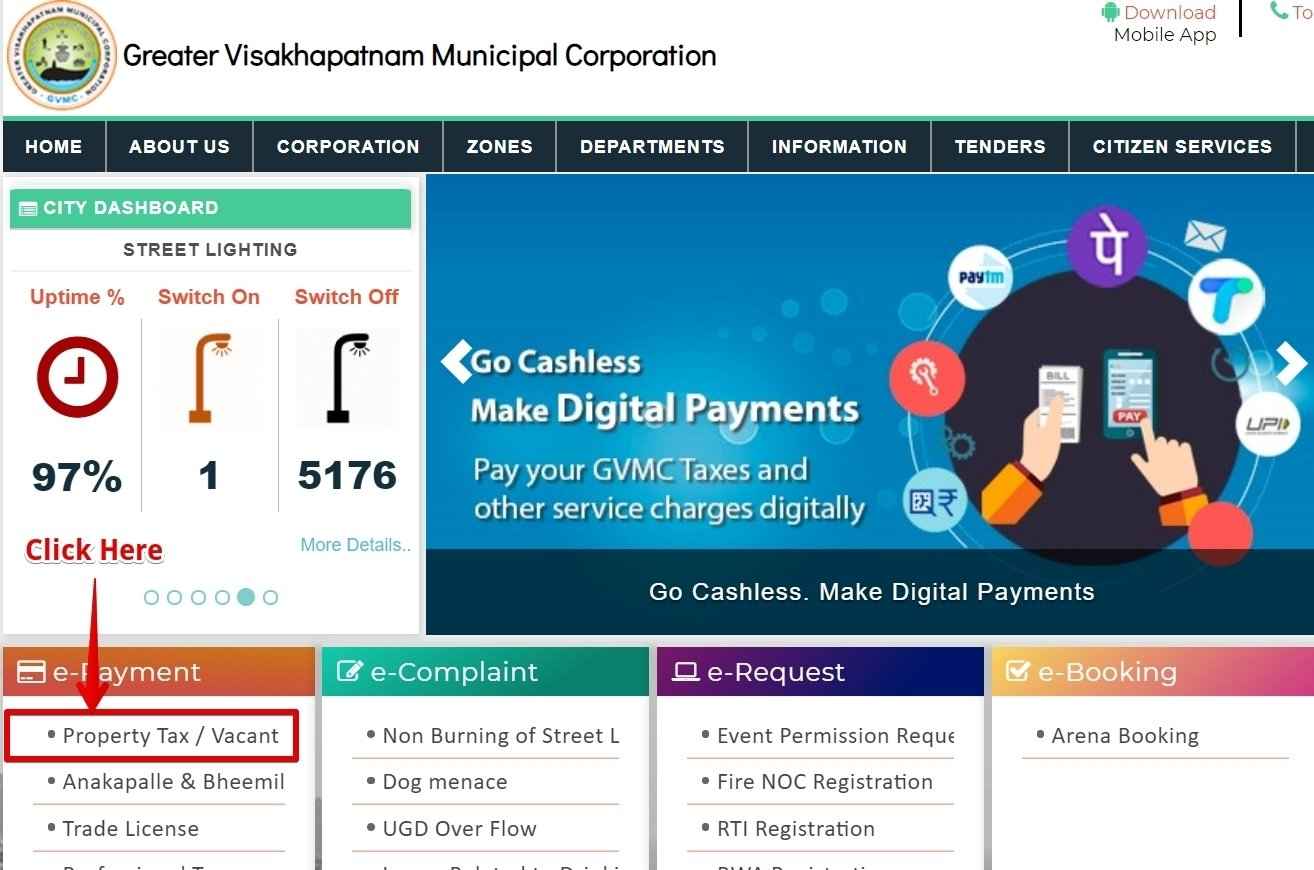

- First, all of you will have to visit the official website of GVMC Andhra Pradesh AP at http://www.gvmc.gov.in/wss/ where under the “e-Payment” section you can check the option of “Property Tax/Vacant”. See the image of the official website home page and option.

Click Here for the GVMC Official Website

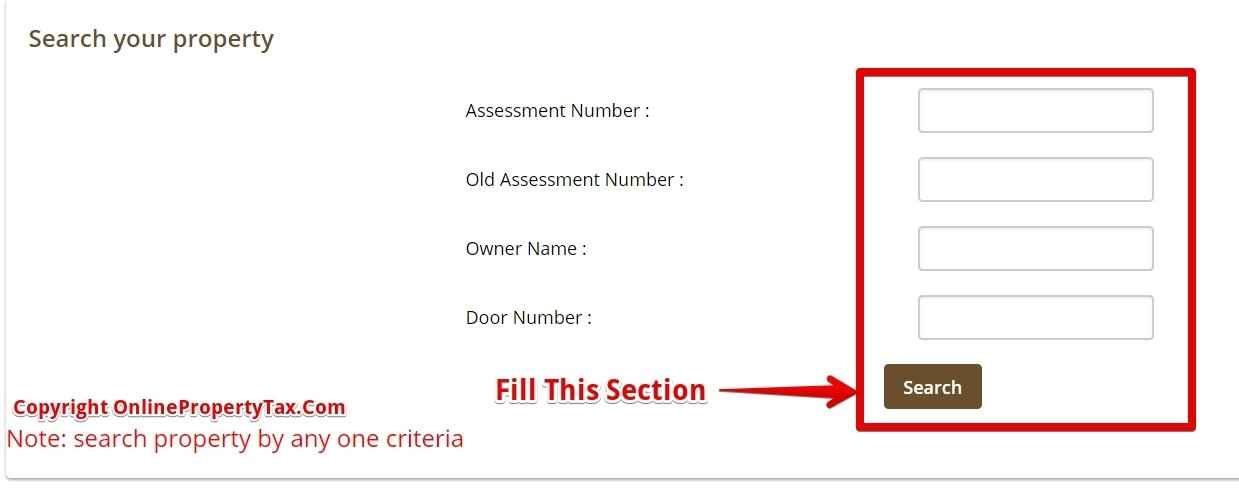

- After clicking on the above option you can see the new page as shown in the image below. You also can reach directly to the payment page directly by providing the link here.

- On this page enter your “Assessment Number, Old Assessment Number, Owner Name, and Door Number”. Now press the search button.

- By pressing the search button you will be able to see all details of your due payments. The citizens will have to pay in favor of Greater Visakhapatnam Municipal Corporation – GVMC.

- You can pay the GVMC Property Tax or File PTR 2023-24 by using your credit/debit card or net banking.

- In the last step download the payment receipt and take the printout in plain paper for future assistance.

Greater Visakhapatnam Municipal Corporation GVMC Helpline

For any solution, we will suggest you use the GVMC’s helpline number. If you are having any doubts related to the GVMC Property Tax then call the below number. The officials will give you all the solutions.

GVMC Toll-Free Helpline Number = 180042500009

Does GVMC (Greater Visakhapatnam Municipal Corporation) have any link to verify status of application for mutation of property and change of name.

Sir, I have paid 18/06/2022,transtion I’d 3639162 Rs.3000 under Transfer to

cfms and 6004786752022IGANUDJQC7 to p.sravanthihttp://www.gvmc.gov.in website vide

Transfer Govt of AP INB CFMS_AND but i i has not shown any receipt to download. Since i am answerable to the amt to sravanthi kindly email me the payment receipt to my email address [email protected]

Hello,

Greetings!!!

Just now we have logged into http://www.gvmc.govt.in portal and have completed the first two steps but , in the third step ,we were unable to complete. But it has shown that our transaction has processed on the other it has declined???

Sir, today 19.6.20 AT 15.51 hrs. I have paid water tax Rs.1440 under hsc no.1086174305 pertaining to my neighbour Sri Madugula Venkata Rao in the http://www.gvmc.gov.in website vide transaction id no.400258278820201GAiUVLPi7

Transfer to37306556729 Govt of AP INB CFMS_AND but i i has not shown any receipt to download. Since i am answerable to the amt to my neighbour M.Venkata Rao, kindly email me the payment receipt to my email address [email protected] ir subramanyams922@ gmail.com. Thank you

Please call Toll Free Number 180042500009 regarding payment receipt related issue, may e bank transition will take 24 hours to back money in your, meanwhile please make a complaint .

How to get copies of paid property tax receipts